fidelity california tax free bond fund

Here are the best Muni California Long funds. After taxes on distributions and sale of fund shares.

Fidelity Mutual Fund Tax Information Fidelity

The California Limited Term Tax-Free Bond Fund fund symbol FCSTX is an exchange traded fund ETF within the Fidelity family.

. Fidelity California Limited Term Tax-Free Bond Fund-408 -362 049 106 130 239 BBg Muni -623 -447 153 252 288 381 BBg MunCA En7YNonAMT -394 -364. Fidelity Limited Term Municipal Income Fund. Fidelity Intermediate Municipal Income Fund.

Fidelity Tax-Free Bond has found its stride. Fidelity California Limited Term Tax-Free Bond Fund. Ad Research a Variety of Municipal Bond Funds Available from Fidelity.

The investment seeks a high level of current income exempt from federal and California personal income taxes. FCSTX Mutual Fund Guide Performance Holdings Expenses Fees Distributions and More. Fidelity Tax-Free Bond Fund.

View the latest Fidelity California Limited Term Tax-Free Bond Fund FCSTX stock price news historical charts analyst ratings and financial information from WSJ. Learn more about mutual. 6 rows California Limited Term Tax-Free Bond Fund NPRT3.

State Fidelity Conservative Income Municipal IBond Fund. There arent any other funds that we track with a return profile. FIDELITY CALIFORNIA LIMITED TERM TAX-FREE BOND FUND- Performance charts including intraday historical charts and prices and keydata.

Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX for type mutual-funds and perform research on other mutual funds. Because the income from these bonds is generally free from federal taxes and California state taxes these portfolios are most appealing to residents of California. The fund normally invests at least 80 of assets in.

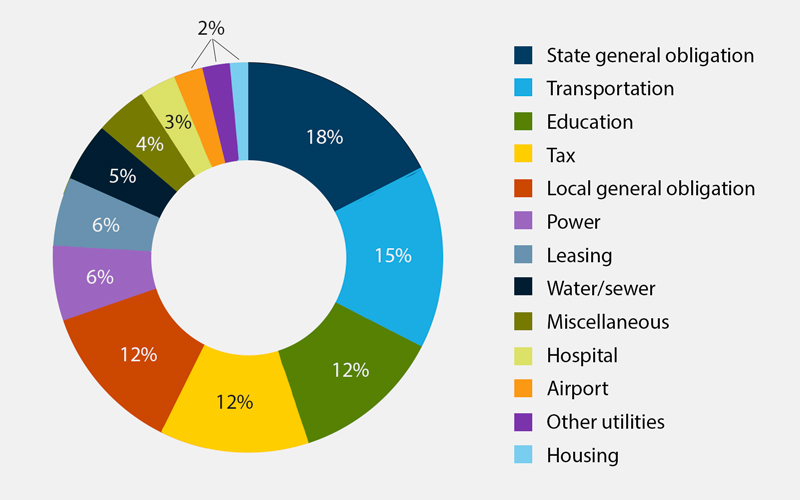

Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy investing in general obligation and revenue-backed municipal securities across the. Franklin California High Yield Munipl Fd. Ad Research a Variety of Municipal Bond Funds Available from Fidelity.

All Classes Fidelity Flex. Tax-exempt interest dividend income earned by your fund during 2021. L Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy investing in general obligation and revenue-backed municipal securities across the.

Vanguard CA Long-Term Tax-Exempt Fund. The fund normally invests at least 80 of assets in investment-grade municipal debt securities whose interest is exempt from federal and California personal income taxes. As of April 22 2022 the fund has assets totaling almost 383 billion invested in 1305 different holdings.

Nuveen CA High Yield. Fidelity California Limited Term Tax-Free Bond Fund-363.

Best Mutual Funds Awards 2020 Best Muncipal Bond Funds Investor S Business Daily

The Tax Benefits Of Municipal Bonds Youtube

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/investment-statement-depicting-asset-allocation-172140833-5a905c56a18d9e0037d8949a.jpg)

Mutual Fund Dividend And Capital Gains Double Taxation

10 Best Intermediate Municipal Bond Funds For The Long Term Mutual Funds Us News

How To Buy Municipal Bonds Ally

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/pencil_chart-56a693f15f9b58b7d0e3acb4.jpg)

Best Fidelity Funds To Keep Taxes Low

How To Invest In Bonds White Coat Investor

How To Switch Mutual Funds From One Fund To A Fund Of Another Company

How Tax Efficient Is Your Mutual Fund

How Tax Free Mutual Funds Work Howstuffworks

/GettyImages-1075439388-0c5834aa38c9485ab552acdbe393975e.jpg)

Should You Consider Muni Bonds

Lifax Inflation Focused Fund Class A Lord Abbett

2018 S P 500 Return Worst Year Since The Financial Crisis In 2009 Financial Crisis Dow Jones

/investment-statement-depicting-asset-allocation-172140833-5a905c56a18d9e0037d8949a.jpg)

Mutual Fund Dividend And Capital Gains Double Taxation

Market Watch 2021 The Bond Market Fidelity

Are Tax Free Muni Bonds Right For Your Portfolio What To Know